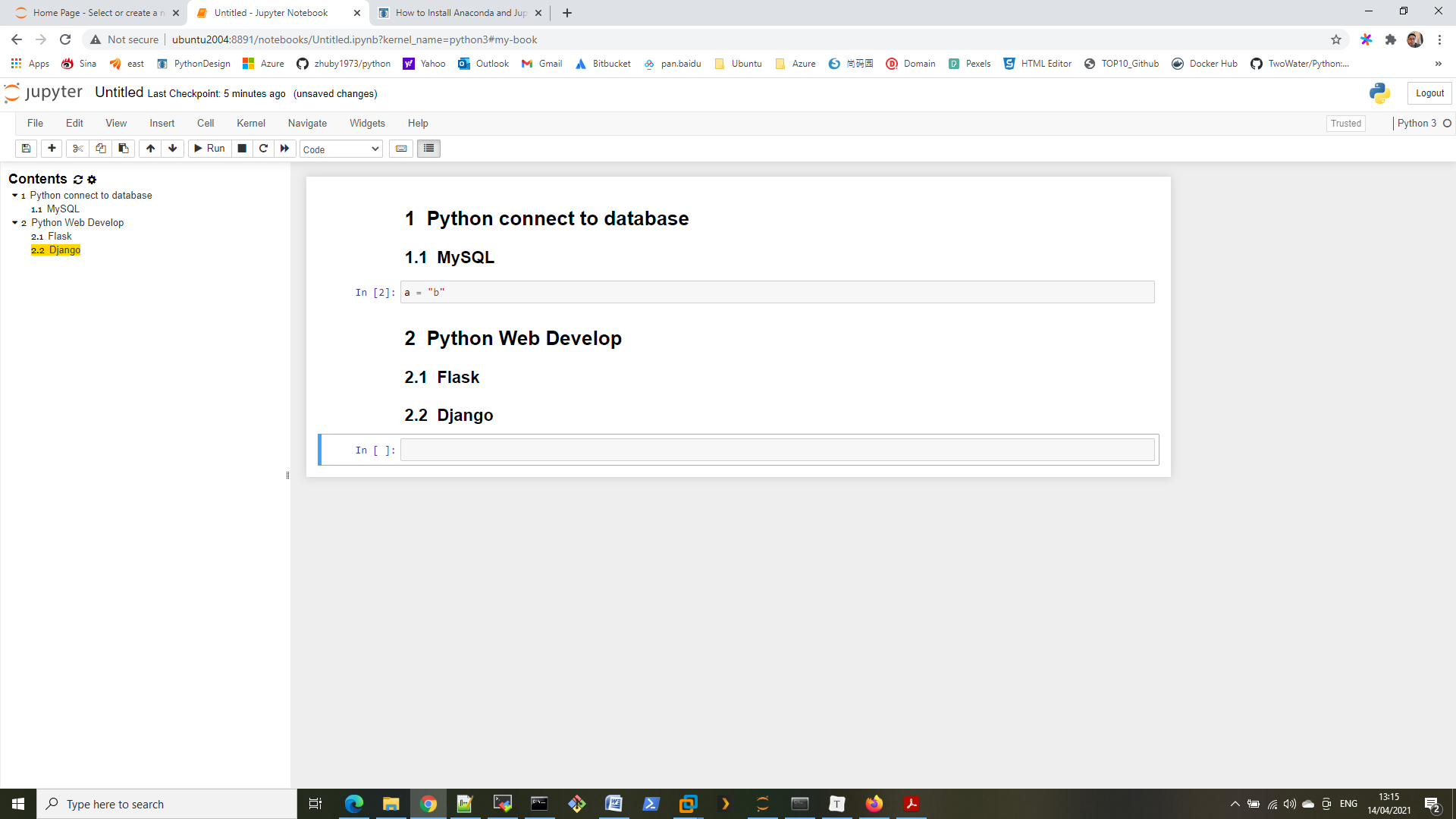

# Algorithmic Stock Trading Strategy Using Python

# compare the simple moving average wi th a 30/100 day to determine the buy/sell price

import math

import pandas_datareader as web

import numpy as np

import pandas as pd

from datetime import datetime

import matplotlib.pyplot as plt

plt.style.use('fivethirtyeight')

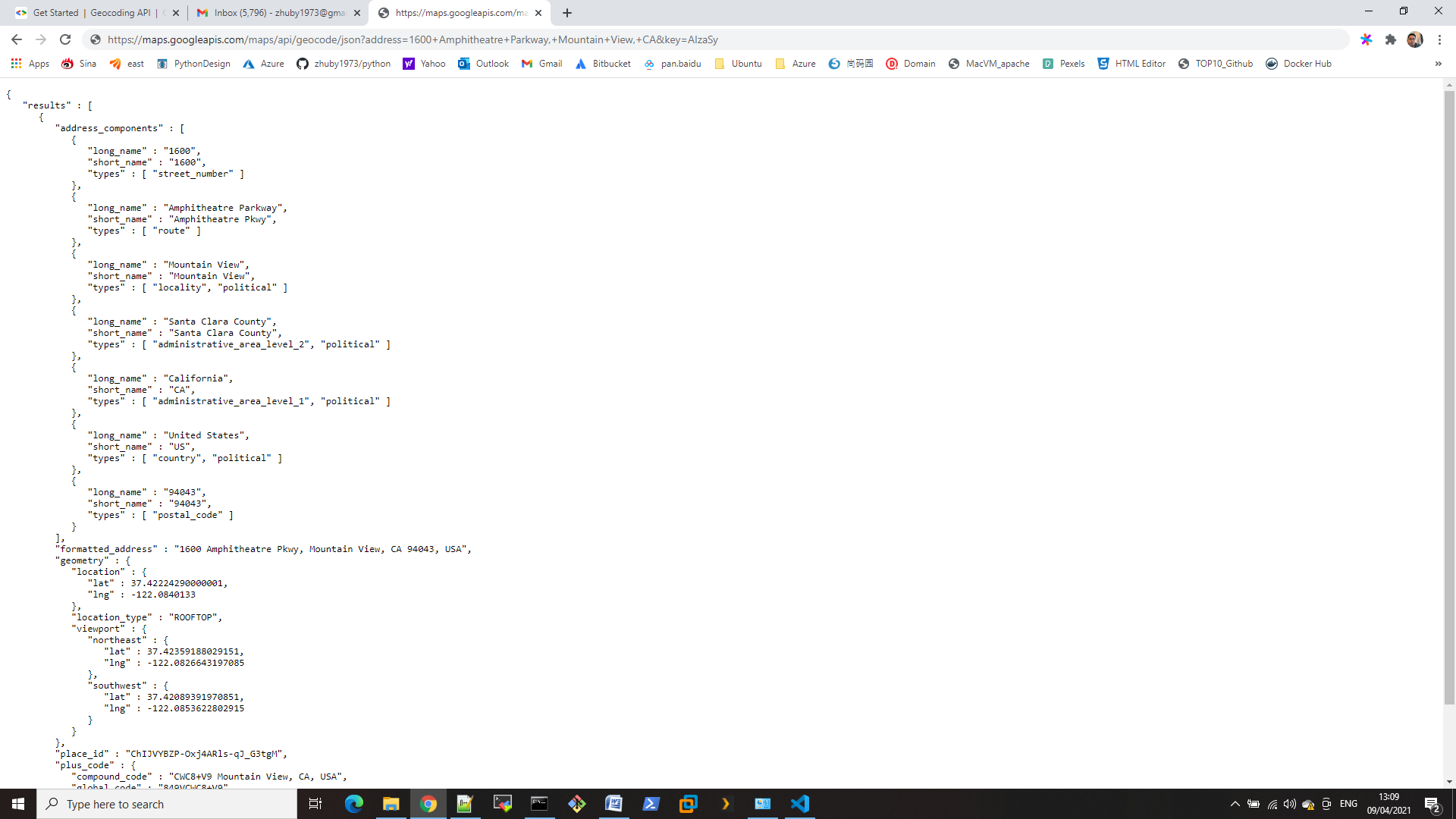

AAPL = web.DataReader('AAPL', data_source='yahoo', start='2012-01-01', end='2021-04-25')

AAPL

| High | Low | Open | Close | Volume | Adj Close | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2012-01-03 | 14.732143 | 14.607143 | 14.621429 | 14.686786 | 302220800.0 | 12.650659 |

| 2012-01-04 | 14.810000 | 14.617143 | 14.642857 | 14.765714 | 260022000.0 | 12.718646 |

| 2012-01-05 | 14.948214 | 14.738214 | 14.819643 | 14.929643 | 271269600.0 | 12.859850 |

| 2012-01-06 | 15.098214 | 14.972143 | 14.991786 | 15.085714 | 318292800.0 | 12.994284 |

| 2012-01-09 | 15.276786 | 15.048214 | 15.196429 | 15.061786 | 394024400.0 | 12.973674 |

| … | … | … | … | … | … | … |

| 2021-04-19 | 135.470001 | 133.339996 | 133.509995 | 134.839996 | 94264200.0 | 134.839996 |

| 2021-04-20 | 135.529999 | 131.809998 | 135.020004 | 133.110001 | 94812300.0 | 133.110001 |

| 2021-04-21 | 133.750000 | 131.300003 | 132.360001 | 133.500000 | 68847100.0 | 133.500000 |

| 2021-04-22 | 134.149994 | 131.410004 | 133.039993 | 131.940002 | 84566500.0 | 131.940002 |

| 2021-04-23 | 135.119995 | 132.160004 | 132.160004 | 134.320007 | 78657500.0 | 134.320007 |

2342 rows × 6 columns

plt.figure(figsize=(16,8))

plt.title('Close Price History')

plt.plot(AAPL['Adj Close'])

plt.xlabel('Date', fontsize=18)

plt.ylabel('Close Price USD$', fontsize=18)

plt.show()

# create the simple moving average with a 30 day window

SMA30 = pd.DataFrame()

SMA30['Adj Close'] = AAPL['Adj Close'].rolling(window=30).mean()

SMA30

| Adj Close | |

|---|---|

| Date | |

| 2012-01-03 | NaN |

| 2012-01-04 | NaN |

| 2012-01-05 | NaN |

| 2012-01-06 | NaN |

| 2012-01-09 | NaN |

| … | … |

| 2021-04-19 | 125.136333 |

| 2021-04-20 | 125.694666 |

| 2021-04-21 | 126.108333 |

| 2021-04-22 | 126.507000 |

| 2021-04-23 | 126.919000 |

2342 rows × 1 columns

# create the simple moving average with a 100 day window

SMA100 = pd.DataFrame()

SMA100['Adj Close'] = AAPL['Adj Close'].rolling(window=100).mean()

SMA100

| Adj Close | |

|---|---|

| Date | |

| 2012-01-03 | NaN |

| 2012-01-04 | NaN |

| 2012-01-05 | NaN |

| 2012-01-06 | NaN |

| 2012-01-09 | NaN |

| … | … |

| 2021-04-19 | 127.688672 |

| 2021-04-20 | 127.882971 |

| 2021-04-21 | 128.067989 |

| 2021-04-22 | 128.228820 |

| 2021-04-23 | 128.407860 |

2342 rows × 1 columns

plt.figure(figsize=(16,8))

plt.title('Close Price History')

plt.plot(AAPL['Adj Close'], label = 'AAPL')

plt.plot(SMA30['Adj Close'], label = 'SMA30')

plt.plot(SMA100['Adj Close'], label = 'SMA100')

plt.xlabel('Date', fontsize=18)

plt.ylabel('Close Price USD$', fontsize=18)

plt.legend(loc='upper left')

plt.show()

# create a new data frame to store all the data

data = pd.DataFrame()

data['AAPL'] = AAPL['Adj Close']

data['SMA30'] = SMA30['Adj Close']

data['SMA100'] = SMA100['Adj Close']

data

| AAPL | SMA30 | SMA100 | |

|---|---|---|---|

| Date | |||

| 2012-01-03 | 12.650659 | NaN | NaN |

| 2012-01-04 | 12.718646 | NaN | NaN |

| 2012-01-05 | 12.859850 | NaN | NaN |

| 2012-01-06 | 12.994284 | NaN | NaN |

| 2012-01-09 | 12.973674 | NaN | NaN |

| … | … | … | … |

| 2021-04-19 | 134.839996 | 125.136333 | 127.688672 |

| 2021-04-20 | 133.110001 | 125.694666 | 127.882971 |

| 2021-04-21 | 133.500000 | 126.108333 | 128.067989 |

| 2021-04-22 | 131.940002 | 126.507000 | 128.228820 |

| 2021-04-23 | 134.320007 | 126.919000 | 128.407860 |

2342 rows × 3 columns

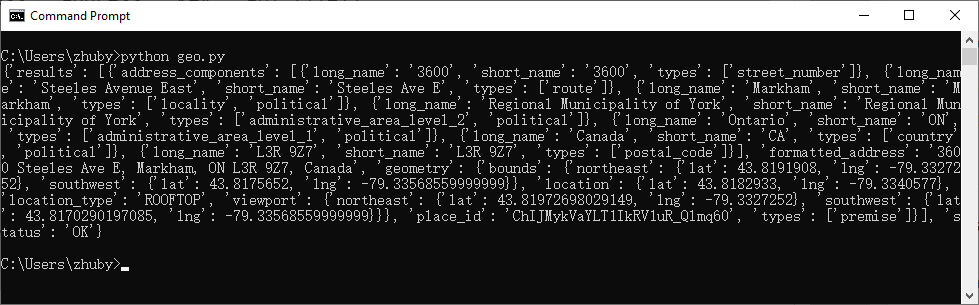

#create a function to signal when to buy and sell

def buy_sell(data):

sigPriceBuy = []

sigPriceSell = []

flag = -1

for i in range(len(data)):

if data['SMA30'][i] > data['SMA100'][i]:

if flag != 1:

sigPriceBuy.append(data['AAPL'][i])

sigPriceSell.append(np.nan)

flag = 1

else:

sigPriceBuy.append(np.nan)

sigPriceSell.append(np.nan)

elif data['SMA30'][i] < data['SMA100'][i]:

if flag != 0:

sigPriceBuy.append(np.nan)

sigPriceSell.append(data['AAPL'][i])

flag = 0

else:

sigPriceBuy.append(np.nan)

sigPriceSell.append(np.nan)

else:

sigPriceBuy.append(np.nan)

sigPriceSell.append(np.nan)

return(sigPriceBuy, sigPriceSell)

#store the buy and sell data into a variable

buy_sell = buy_sell(data)

data['Buy_Signal_Price'] = buy_sell[0]

data['Sell_Signal_Price'] = buy_sell[1]

data

| AAPL | SMA30 | SMA100 | Buy_Signal_Price | Sell_Signal_Price | |

|---|---|---|---|---|---|

| Date | |||||

| 2012-01-03 | 12.650659 | NaN | NaN | NaN | NaN |

| 2012-01-04 | 12.718646 | NaN | NaN | NaN | NaN |

| 2012-01-05 | 12.859850 | NaN | NaN | NaN | NaN |

| 2012-01-06 | 12.994284 | NaN | NaN | NaN | NaN |

| 2012-01-09 | 12.973674 | NaN | NaN | NaN | NaN |

| … | … | … | … | … | … |

| 2021-04-19 | 134.839996 | 125.136333 | 127.688672 | NaN | NaN |

| 2021-04-20 | 133.110001 | 125.694666 | 127.882971 | NaN | NaN |

| 2021-04-21 | 133.500000 | 126.108333 | 128.067989 | NaN | NaN |

| 2021-04-22 | 131.940002 | 126.507000 | 128.228820 | NaN | NaN |

| 2021-04-23 | 134.320007 | 126.919000 | 128.407860 | NaN | NaN |

2342 rows × 5 columns

#visualize the data and the strategy to buy and sell

plt.figure(figsize=(16,8))

plt.title('Close Price History')

plt.plot(data['AAPL'], label = 'AAPL', alpha = 0.35)

plt.plot(data['SMA30'], label = 'SMA30', alpha = 0.35)

plt.plot(data['SMA100'], label = 'SMA100', alpha = 0.35)

plt.scatter(data.index, data['Buy_Signal_Price'], label = 'Buy', marker = '^', color = 'green')

plt.scatter(data.index, data['Sell_Signal_Price'], label = 'Sell', marker = 'v', color = 'red')

plt.xlabel('Date', fontsize=18)

plt.ylabel('Close Price USD$', fontsize=18)

plt.legend(loc='upper left')

plt.show()